24

Mar

The high profile of infrastructure and access to related services in the communiques of the World Bank and the International Monetary Fund (IMF) at their annual meetings in late 2014 underscores the importance of this issue for development worldwide. Nowhere is lack of infrastructure more crucial and potentially transformational than in sub-Saharan Africa. In 2009, the World Bank and major donors and multilateral institutions investigated this challenge of addressing the region’s glaring infrastructure gap.1

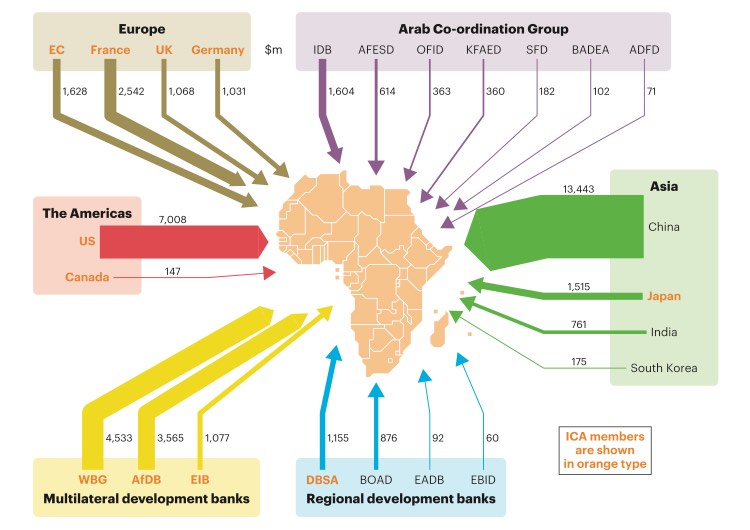

That comprehensive regional analysis aimed to establish “a baseline against which future improvements in infrastructure services can be measured” and guide priority investments and policy reforms. The analysis estimated that the region needed $93 billion per year to fill the infrastructure gap. In the five years since the study, the response in tackling the infrastructure gap has been unprecedented, especially in terms of increased financing. Although it is too early to expect substantive results from these efforts, given the long gestation period of infrastructure investments, it is important at this time to review and analyze how this response is distributed across the countries of sub-Saharan Africa and the different infrastructure sectors/sub-sectors. Are there “orphan” sectors or countries that should be the subject of targeted emphasis? Is there an appropriate balance between regional, national, and sub-national infrastructure? Is there sufficient attention to global governance that would ensure strategic coordination, and to sectoral governance that would reduce additional financing requirements through increased efficiency and thereby better ensure sustainability? The purpose of this paper is to begin that conversation by analyzing how the main sources of infrastructure financing have evolved over the last eight years,2 the distribution of that financing by country and sector, and how financing efforts have responded to the recommendations made in 2009. Thus, this paper offers recommendations on how to better exploit the political, technical, and financial synergies needed to address the infrastructure gap. It is not feasible in this analysis to assess specific investments against actual needs by country and sector, and so this report underscores the need for an update of the 2009 study.

Access and download the full Brookings report at: http://www.brookings.edu/~/media/Research/Files/Reports/2015/03/financing-african-infrastructure-gutman-sy-chattopadhyay/AGIFinancingAfricanInfrastructure_FinalWebv2.pdf?la=en